South, North score on business sentiments

13 May 2021

Opinion: Bornali Bhandari Samarth Gupta Ajaya Kumar Sahu and K Subbaraje Urs

The East’s low may worsen the regional imbalance as the second Covid wave rages on.

The NCAER Business Confidence Index (BCI) a measure of business sentiments fell for two consecutive quarters in 2019-20:Q4 and 2020-21:Q1 on a quarter-on-quarter basis. After the lockdown restrictions were withdrawn business sentiments recovered in a V-shaped form in 2020-21:Q2 and then at a moderating pace in Q3. However the index has remained virtually unchanged between Q3 and Q4.

The NCAER Business Expectations Survey (N-BES) collects data from six cities representing four regions. Bengaluru and Chennai represent the South; Mumbai and Pune West; Delhi North and Kolkata for East.

Being major urban centres these six cities accounted for a large share of Covid cases in March. Amongst the six cities included in the N-BES sample Pune was one of the worst affected accounting for 11 per cent of the total cases in India in March. This was followed by Mumbai (7.5 per cent) Urban Bengaluru (2.4 per cent) Delhi (1.9 per cent) Chennai (1.2 per cent) and Kolkata (0.4 per cent). Together the six cities accounted for 24.5 per cent of the total national cases in India in March 2021.

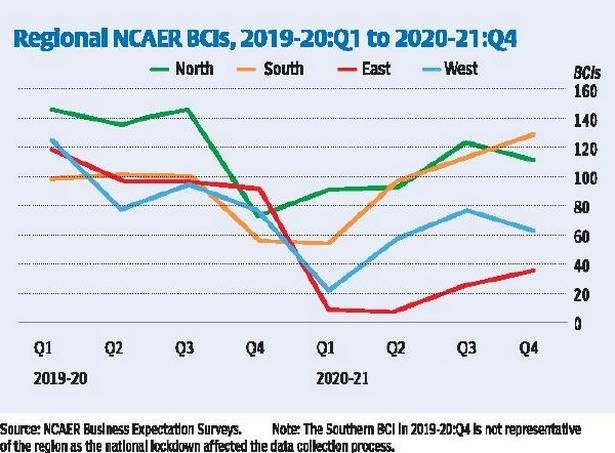

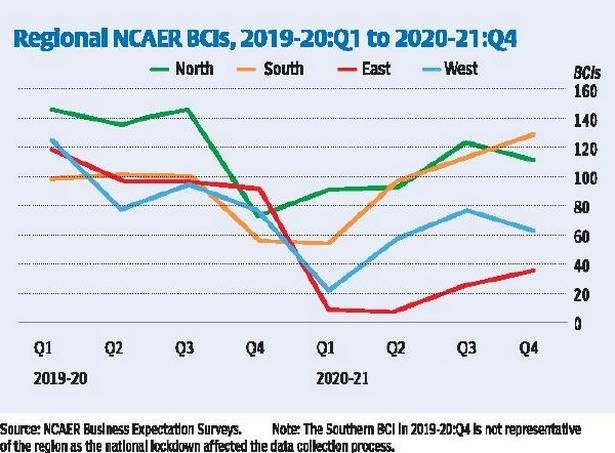

Figure 1 shows the divergence of regional business sentiments after 2019- 20:Q4. The range (maximum minus minimum) of the four regional BCIs fell from 57.6 in 2019-20:Q2 to 34.7 in 2019-20:Q4. It rose to 81.1 in 2020-21:Q1 and reached its peak at 97.3 in 2020-21:Q3. The Q4 has seen the range falling to 92.0.

Business sentiments in the North have been quite robust. In 2020-21:Q1 it was the only region which experienced improving business sentiments despite coinciding with the national lockdown. Business sentiments in the North improved steadily in Q2 and Q3 of 2020-21 but saw some moderation in Q4.

In contrast business sentiments in the South have seen improvement for three consecutive quarters in Q2 Q3 and Q4 of 2020-21. The BCI of the South recovered rapidly to converge with the North in Q2 and Q3 and outpaced the latter in Q4 of 2020-21. Overall business sentiments of the two regions were relatively buoyant and close to each other compared to East and West.

The BCI of the West has been lower than the North and South (Figure 1) but higher than the East. After falling for two consecutive quarters in 2019-20:Q4 and 2020-21:Q1 BCI recovered in Q2 and Q3 of 2020-21 but fell again in Q4 of 2020-21. This coincided with the survey period when the second wave of the Coronavirus cases had hit both Pune and Mumbai as mentioned earlier.

Before the pandemic the BCI of the East was close to other regions. The eastern BCI fell from 90.9 in 2019-20:Q4 to 9.7 in 2020-21:Q1 and stayed at 9.2 in 2020-21:Q2.

Although business sentiments have recovered in Q3 and Q4 the eastern BCI remained the lowest amongst all the regions.

The BCI is driven by four components with equal weights in the Index: ‘overall economic conditions will improve in next six months’ ‘ financial position of firms will improve in next six months’ ‘present investment climate is positive as compared to six months ago’ and ‘present capacity utilisation is close to or above the optimal level’.

We specifically discuss the East. Only 1.7 per cent of firms in the East responded that “overall economic conditions will be better in next six months” and “present investment climate is positive”. These two form the macro components of the BCI which means that Eastern firms’ macro perceptions of the economy is very weak. The gap between the East and South on these components is quite marked. Last but not the least only 6.1 per cent of firms in the East perceived that “financial position of firms will improve in next six months”.

Business sentiments are weak across regions for the “present investment climate” is positive. While the share of positive responses of firms are 60 per cent in the South it was lower than almost 30 percentage points in other regions. Sentiments about capacity utilisation in the North is the highest at 94.4 per cent. It is but obvious that this is going to suffer in the first quarter as lockdown was imposed in Delhi in April-May 2021.

In sum the last fiscal has seen a large variation in business sentiments regionally. Business sentiments recovered fairly quickly in the northern and southern regions. In particular firms’ business sentiments in the eastern region have lagged behind especially the macro sentiments. Essentially the improvement in the eastern BCI seen in Q3 and Q4 have been driven by improvements in capacity utilisation. The pessimistic macro business sentiments in this region is worrisome. It has implications for future economic growth investment employment etc. in the region. Although better than in the East business sentiments in the West remained very weak too and have been driven by improvements in capacity utilisation. At the national level imbalanced regional growth can have its own set of implications. Given the on- going second wave of the Covid-19 the government has to walk a very fine tightrope between lives and livelihoods. More importantly it is puzzling why firms’ sentiments have not recovered in the East and West despite normalising economic patterns.

Bhandari is a Senior Fellow Gupta and Urs are Associate Fellows and Sahu is a Senior Research Analyst at NCAER. Views expressed are personal.