NCAER's Business Confidence Index rises in the second quarter of 2015-16 by 6.3%

01 Dec 2015

Highlights of NCAER’s most recent Business Expectations Survey for Quarter 2 2015–16

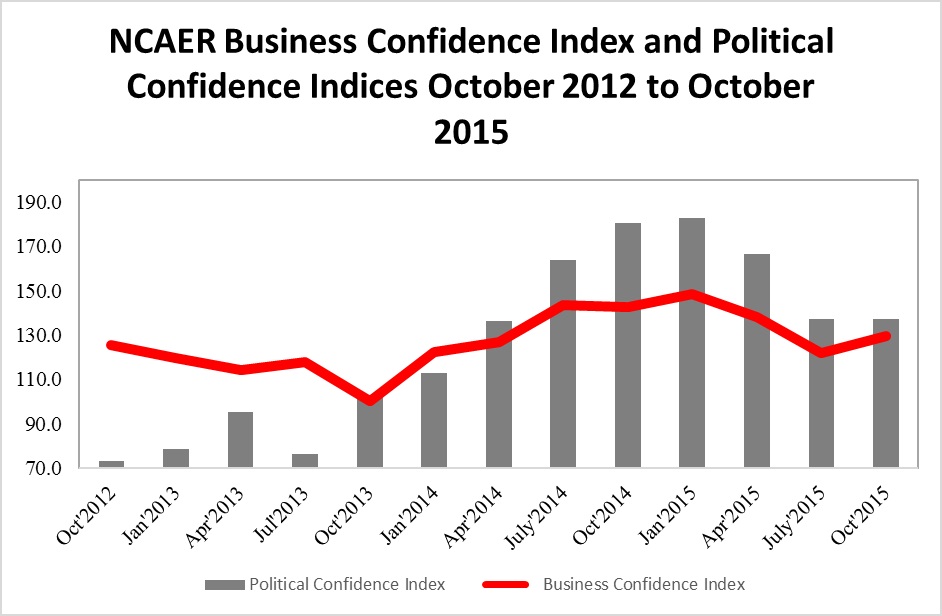

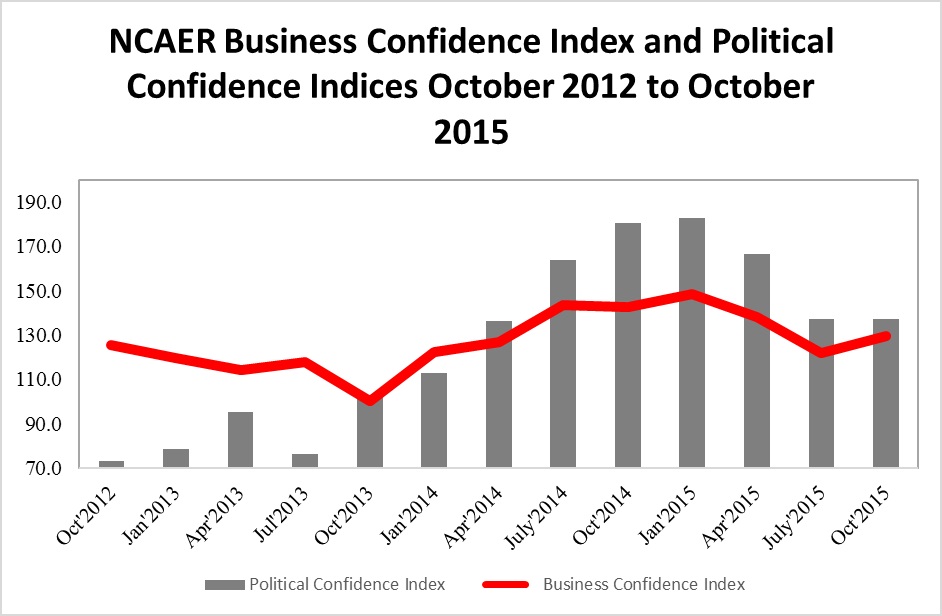

- The 94th round of the Business Expectations Survey (BES) carried out in September 2015 shows a revival of business sentiments after the Business Confidence Index (BCI) fell for two consecutive quarters. The BCI shows an increase of 6.3% in October 2015 over July 2015 on a quarter-on-quarter (q-o-q) basis. However the BCI continues to fall on a year-on-year basis (9.1%).

- All but one of the four components of the BCI show improvement in sentiments between July and October 2015. Three components showing improvement in terms of percentage of respondents in October 2015 versus July 2015 are ‘overall economic conditions will improve in the next six months’ ‘financial position of firms will improve in the next six months’ and ‘present investment is climate is positive compared with six months ago’. The percentage of respondents saying that ‘present capacity utilisation is close to or above optimal level’ declines from 93.5% in July 2015 to 91.3% to October 2015.

- All five sectors show improvement in business sentiments in October 2015 on a q-o-q basis. The services sector has the highest BCI followed by intermediate goods consumer non-durables consumer durables and capital goods in this current round. The BCI of the intermediate goods sector shows the highest q-o-q increase of 14.6% followed by the services sector (8.8%).

- All but the West show improvement in the BCI. The BCI of the South shows an increase of 25.9% followed by the East (3.7%). The BCI declines in the West by 3.9%.

- Barring the ` 500 crore plus companies which show a q-o-q decline in the BCI all other firms show improvement. Firms with an annual turnover of less than ` 1 crore which have the lowest BCI show 10.5% q-o-q growth in BCI. The ` 1–10 crore firms show an improvement of 7.2%. The maximum increase has been experienced by ` 100 –500 crore firms (15.2%).

- The distribution of firms by ownership type reveals improvement in the BCI in all but the public sector companies with private limited companies rising the maximum (8%). The BCI of public sector companies has fallen by 6.3%.

- Overall sentiments regarding production domestic sales exports imports of raw materials pre-tax profits and costs are dampened in October 2015 compared to July 2015. Significant exceptions to the overall trends are the capital goods and service sectors. Labour markets continue to be weak as expectations about hiring have only worsened from the last quarter.

- The slide in the Political Confidence Index (PCI) seems to be stabilising in October 2015 when it shows a q-o-q rise of 0.3%. Components that show an increase in positive responses between July and October 2015 are ‘managing inflation’ ‘managing overall economic growth’ ‘managing conducive political climate’ and ‘managing unemployment’. Components showing a decline in positive responses in the same period are ‘managing government finances’ ‘managing exchange rate’ ‘external trade negotiations’ and ‘pushing economic reforms forward’. Increase or decrease in positive responses notwithstanding the percentages of positive responses are not more than 60% for any of the PCI components. The percentage of positive responses is the worst for ‘managing exchange rate’ (28.5%) followed by ‘managing unemployment’ (34.9%) and ‘managing inflation’ (37.9%). The best performing parameters are ‘managing overall economic growth’ and ‘external trade negotiations (both bilateral and multilateral)’ with the percentage of positive responses being 58.8% and 55% respectively.

Dr Bornali Bhandari Fellow NCAER noted “the economy shows signs of bottoming out but the recovery remain weak and fraught with uncertainty. There is improvement in business sentiments and stabilising of political sentiments. The improvement in sentiments of small and medium enterprises is the best signal that this survey shows. The capital goods and services sectors also show improvement in sentiments. However the percentage of respondents saying that ‘present investment is climate is positive’ remains at 43.3% in October 2015 thereby signalling that investment sentiments still remain subdued. And the continued weak expectations on hiring labour in the next six months and weak confidence in ‘managing unemployment’ imply that improvement in business sentiments may not necessarily translate to more jobs in the near future.”

Brief Methodology: The National Council of Applied Economic Research (NCAER) has been conducting the Business Expectations Survey (BES) every quarter since 1991. It tracks the business sentiments of more than 500 Indian companies to compute a composite index the Business Confidence Index (BCI). The survey consists of responses from firms/industries across six cities to assess business sentiments in four regions of India. Delhi NCR represents the North Mumbai and Pune represent the West Kolkata represents the East and South is represented by Bangalore and Chennai. Industries are adequately represented with regard to ownership type (namely public sector private limited public limited partnership/individual ownership and MNCs) industry sector (namely consumer durables consumer non-durables intermediate goods capital goods and services sector) and firm size based on their annual turnover (in the range of less than ₹1 crore ₹1 to 10 crore ₹10 to 100 crore ₹100 to 500 crore and more than ₹500 crore). The sample is drawn randomly from a list of industries in each city drawn from various sources. A sizeable number of units taken in one round are retained in the next round to maintain continuity of analysis.

The Business Confidence Index (BCI) is based on four questions that carry equal weight. Two questions are devoted to macro factors and the other two to micro factors. The BCI is a simple average of all the positive responses to three questions and on the fourth question (capacity utilisation) an average of the sum of the responses to improvement versus no improvement is taken. Then the BCI is compared with the base value to obtain the change. If the BCI increases for a particular round it is due to a larger proportion of positive responses in that round. The positive responses may increase for a specific question. An increase in the level of the BCI reflects optimism in the business sector about the performance of the economy.

About NCAER

NCAER the National Council of Applied Economic Research is India’s oldest and largest independent economic think tank set up in 1956 at the behest of Prime Minister Jawaharlal Nehru to inform policy choices for both the public and private sectors. Over nearly six decades the NCAER has served the nation well with its rich offering of applied policy research unique datasets evaluations and policy inputs to central and state governments corporate India the media and informed citizens. It is one of a few independent think tanks worldwide that combines rigorous economic analysis and policy outreach with data collection capabilities particularly for large-scale household surveys. The NCAER is currently led by its Director-General Dr Shekhar Shah and governed by an independent Governing Body chaired by Mr Nandan M. Nilekani.

Media Contact

Dr Bornali Bhandari & Ms Shilpi Tripathi

NCAER| National Council of Applied Economic Research

11 Parisila Bhawan

IP Estate New Delhi

(T) : 011-2345-2605 (D) 011-2337-9861 Email: stripathi@ncaer.org