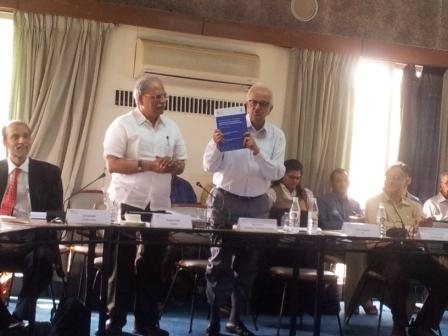

Malcolm Adiseshiah Mid-Year Review of the Indian Economy 2014-15

01 Nov 2014

Past Event

New Delhi, Saturday, 1 November 2014: At a seminar held at the India International Centre, New Delhi, the National Council of Applied Economic Research (NCAER) presented the Mid-Year Review of the Economy, 2014-15. The Review covered the performance of the economy during first half of the current year (April – September 2014-15). It also included two special papers on ‘Financial inclusion in India: why distinguishing between access and use has become even more important’ and ‘India’s Bilateral Trade in Services: Patterns, Determinants and the Role of Trade in Goods’, both issues of critical importance to the economy.

Agriculture

- Deficient monsoon is bound to affect agricultural output, especially in rain-fed areas, which account for about 55-60% of the area sown.

- NCAER’s estimates based on regression models (incorporating the impact of rainfall as well as a trend factor) anticipate a 2% to 4% deficit in overall Kharif food grain output as compared to a higher estimate of around 7% by the Agriculture ministry.

- Lower agricultural output has implications for GDP growth and inflation. In addition, it has huge welfare implications since close to 60% of the population is still dependent on agriculture.

Industry and Services

- After welcome growth of 4.2% in 2014–15:Q1, industrial growth disappointed in July and August 2014 registering a growth of just 0.4% year-on-year in each of the two months.

- Manufacturing Industry proved the biggest disappointment, with the growth rate contracting by 1% and 1.4% in July and August respectively, even though a 3.5% growth was witnessed in the first quarter.

- Gross Fixed capital formation (GFCF) brought in some consolation with a 7% YoY growth inQ1 of FY15, the highest since Q1 FY12.

- However, it is viewed that soon the improvement in the performance of core industries will get translated to better performance in the industry overall. The combined efforts of RBI and prompt actions by government and its committed agenda for industry sector may turn around the industrial sector and give an impetus to overall economic growth.

- The services’ sector grew 6.8% in Q1 FY15, however it is well below the close-to-double digit growth recorded during 2005-06 and 2007-08. Within the services sectors there is a wide variation with trade, hotel and restaurants and construction showing a slower growth compared to community and personal services.

Monetary Conditions

- Money and credit markets have been largely stable during the first half year. Stock markets, equity as well as bond remained steady while credit markets remained subdued.

- Growth in bank credit fell to a five year low at 10.9% at the end of August 2014, the asset-quality continues to decline though at a slower pace.

- Bank deposits grew 13.6% up to the third week of August 2014 compared to 12.6% during the comparable period last fiscal suggesting that financial assets might once again become attractive.

- Equity markets touched new highs, riding on a surge in overseas inflow. After touching a record high in September 2014, the slower FII inflows in response to jitters about the fed taper led to some correction in the BSE Sensex.

External sector

- After recording a strong performance of double digit growth in May and June 2014, export growth slowed down in subsequent months with a growth rate of just 2.73% in September 2014.

- The trade balance improved in the Q1 from $33bn, down from $48bn in the comparable period in FY14. However with the slowed down exports and with the imports climbing 26% in September 2014, the trade deficit rose to an 18 month high in September 2014.

- The slow appreciation of the rupee, combined with the uncertain recovery in the rest of the world, is likely to impact export performance in the coming months.

- Overall, not everything is bleak on the export front. India has diversified its export basket and markets. The new Foreign Trade Policy for 2014-19 may bring in a number of new initiatives to promote exports.

Prices

- There has been some good news on the inflation front, with the retail inflation falling to 6.46% in September 2014, down from 8.59% in April l 2014 as the CPI inflation ruled below 8% for the fourth successive month.

- The decline in food inflation from 8.6% in April 2014 to 3.52% in September 2014 has helped the softening in inflation at large.

- Inflation based on the wholesale price index (WPI) also fell to a 59-month low of 2.38% in September 2014 , down from 5.25% in April 2014

Public Finance

- The first quarter GDP numbers suggest growth might be bottoming out with some ups and downs. At 5.7%, GDP growth during April- June 2014 is one percentage higher than in the comparable period last fiscal and highest in the previous nine quarters.

- The Budget presented in June 2014 saw the fiscal deficit to GDP ratio being retained at 4.1% for FY15 while the fiscal deficit during the period April-August 2014 has touched almost 75% of the budget estimate for the entire year.

- Non-plan expenditure has grown by little over 4% in the first five months as against 9.4% growth projected in the Budget. Food subsidies are also lower at Rs 62,000 crore during the first five months of FY15.

The Mid Year review includes two special papers on ‘Financial inclusion in India: why distinguishing between access and use has become even more important’ and ‘India’s Bilateral Trade in Services: Patterns, Determinants and the Role of Trade in Goods’, both issues of critical importance to the economy. Indira Iyer’s paper traces the development of policies that promoted financial inclusion and suggests the way forward. Seema Sangita’s paper on bilateral trade analyses the patterns and determinants of bilateral trade in services in the case of India.