Press Release: NCAER-NSE Business Expectations Survey for 2022–23:Q3

23 Jan 2023

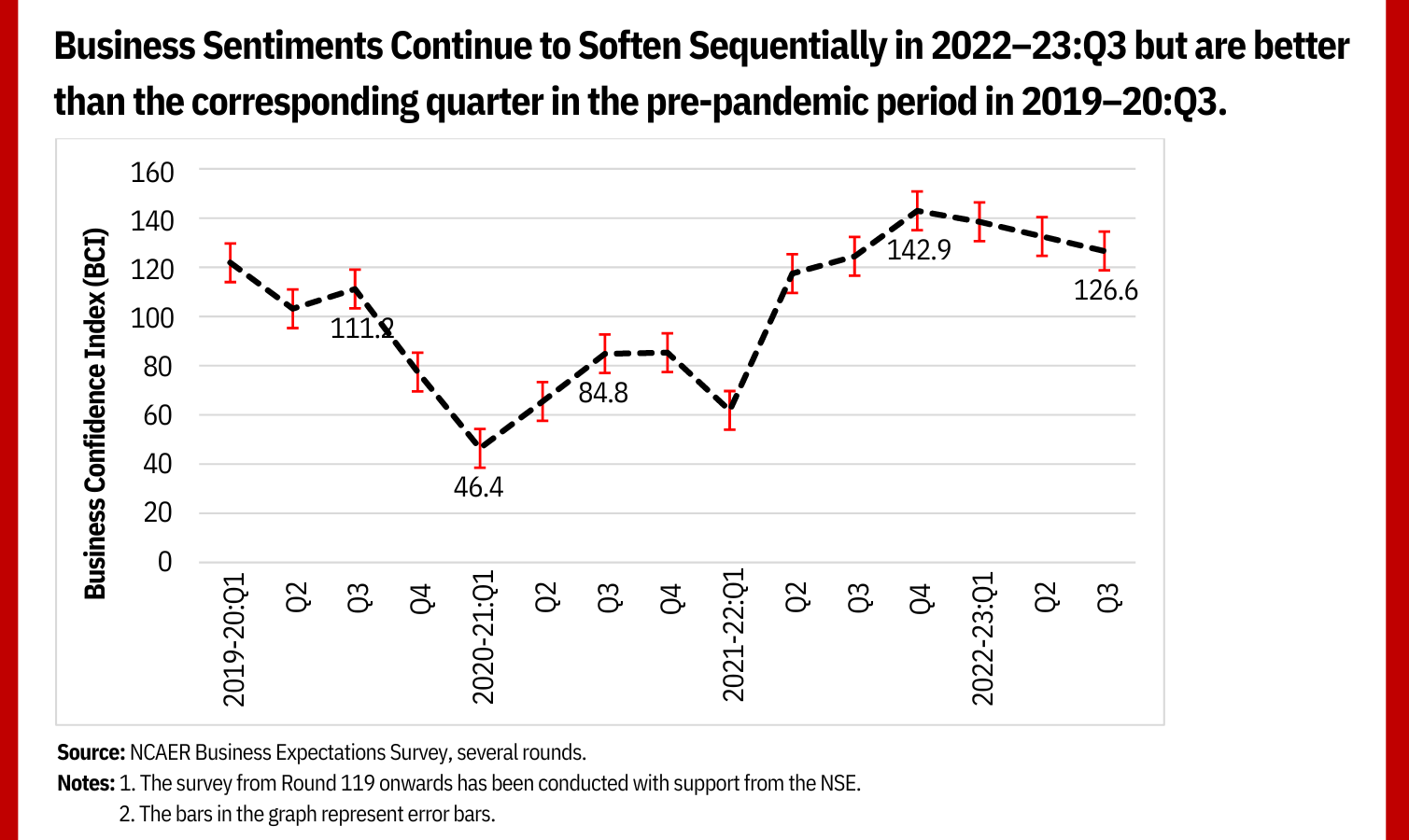

The Business Confidence Index is higher than it was a

year ago but has softened sequentially

The National Council of Applied Economic Research (NCAER), one of India’s premier economic policy research think tanks, carried out the 123rd Round of its Business Expectations Survey (BES) in December 2022, with support from the National Stock Exchange of India Limited (NSE). NCAER has been carrying out the BES every quarter since 1991, covering 500 firms across four regions.

The NCAER-NSE Business Confidence Index (BCI) has recovered from the lows of the pre-pandemic (2019–20) and pandemic years 2020–21 and 2021–22. It is higher at 126.6 in 2022–23:Q3 than it was recorded a year ago at 124.4 in 2021–22:Q3. However, sentiments continued to soften sequentially in the first, second and third quarters of 2022–23.

Sentiments relating to macro conditions remained relatively buoyant in 2022–23:Q3 as compared to 2022–23:Q2. The share of positive responses increased for the component, ‘overall economic conditions will improve in the next six months’ and remained unchanged for the component, ‘present investment climate is positive’. In contrast, sentiments pertaining to firms’ own conditions softened between the two quarters for the components, ‘financial position of firm will improve in the next six months’ and ‘present capacity utilisation is close to or above the optimal level’. The latest BES Report can be accessed and downloaded from here.

Methodology: NCAER has been conducting the BES every quarter since 1991. The BES findings reported here relate to 500 firms. The survey elicits responses from firms across six cities to assess business sentiments in the four regions of India: Delhi-NCR, representing the North; Mumbai and Pune, the West; Kolkata, the East; and Bengaluru and Chennai, the South. All the industries are represented in terms of ownership type (including public sector, private limited, and public limited firms, partnerships/individually owned firms, and multinational corporations); the industry sector (including consumer durables, consumer non-durables, intermediate goods, capital goods, and services); and firm size based on the annual turnovers of the firms (in the range of less than or equal to ₹1 crore, more than ₹1 crore to less than or equal to 10 crore, more than ₹10 crore to less than or equal to ₹100 crore, more than ₹100 crore to less than or equal to 500 crore, and more than ₹500 crore). The sample is drawn randomly from a list of firms in each city. A sizeable number of units taken in one round are retained in the next round to maintain continuity of the analysis.

The BCI is computed on the basis of responses from firms to four questions. Two of these questions focus on macro factors and the other two on micro factors. All the questions carry equal weight. The BCI is a simple average of all the positive responses in the case of three questions, whereas in the case of the fourth question on capacity utilisation, an average of the sum of the responses indicating ‘improvement’ and ‘status quo’ is taken. Thereafter, the BCI is compared with the base value (denoted by the value of 100 in Round 7; 1993) to determine any change. An increase in the level of the BCI (signified by a larger share of positive responses) reflects optimism in the business sector about the performance of the economy.